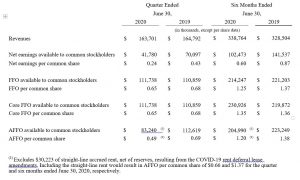

- Revenues and net earnings, FFO, Core FFO and AFFO available to common stockholders and diluted per share amounts:

Second Quarter 2020 Highlights:

Second Quarter 2020 Highlights:

- Portfolio occupancy was 98.7% at June 30, 2020 as compared to 98.8% at March 31, 2020 and 99.0% at December 31, 2019

- Invested $6.9 million in property investments, and completed construction on 8 properties with an aggregate 67,000 square feet of gross leasable area

- Sold 8 properties for $3.8 million producing $0.7 million of gains on sales

- Raised $52.6 million net proceeds from the issuance of 1,438,695 common shares

- Ended the quarter with $224.6 million of cash and no amounts drawn on $900 million bank credit facility

- Invested $74.1 million in property investments, including the acquisition of 21 properties with an aggregate 284,000 square feet of gross leasable area at an initial cash yield of 9%

- Sold 22 properties for $40.1 million producing $13.5 million of gains on sales

- Raised $53.3 million net proceeds from the issuance of 1,451,223 common shares

- Issued $400 million principal amount of 50% senior unsecured notes due 2030 generating net proceeds of $395.1 million

- Issued $300 million principal amount of 10% senior unsecured notes due 2050 generating net proceeds of $290.5 million

- Paid off $325 million principal amount of 3.800% senior unsecured notes due 2022